Set up your shop

Funding my project

The easiest way to calculate break-even point for retailers

2 June 2023

If you are thinking about beginning a small retail business or are already operating one, there is one essential question you need to ask yourself: What is the quickest way to calculate the break-even point for my retail store? Having the ability to calculate the break-even point can help you make key financial decisions regarding your retail store.

If you know the steps to achieve financial neutrality you also know the steps that must be taken for your retail store sustainability, and how to achieve success and generate a profit.

In this guide, you will find all the required information for performing a break-even point analysis. We will discuss its importance, as well as the various approaches that can help lower the breaking point for your business.

Summary

- What is a Break-Even Point for Businesses?

- What Does A Break-Even Analysis Mean?

- How to Calculate Break-Even Point in Five Easy Steps

- What Is the Break-Even Formula?

- Break-Even Point Example

- Why Is the Break-even Analysis Important?

- How to Lower Your Break-Even Point

- How Can Ankorstart Help Your Business Thrive

- FAQ

What is a Break-Even Point for Businesses?

The point at which a company has reached “break-even” status is the point at which its total revenues and total operating expenses are equal to one another. An essential component of every business plan is carrying out a break-even point calculation to ensure the moment at which the company will be profitable again. The purpose of this financial analysis is to help business owners assess whether or not their new business concept has a probability of being profitable.

“The break-even theory is based on the fact that there is a minimum product level at which a venture neither makes profit nor loss.” – M.B. Ndaliman, An Economic Model for Break-Even Analysis

What Does A Break-Even Analysis Mean?

A calculation known as a break-even analysis provides owners of small businesses with information regarding the quantity of a product to be sold for the business to profit. It assists business owners in formulating pricing strategies that would not only cover their expenses but also result in a gross profit.

You need to be familiar with both your fixed and variable costs if you want to completely understand your company’s break-even analysis.

Fixed Costs: Expenses that do not change regardless of how much of a product or service is sold.

Variable Costs: Expenses that rise and fall depending on the volume of production or sales.

How to Calculate Break-Even Point in Five Easy Steps

Step #1 – Determine Variable Unit Costs

As a retailer, your variable costs are relatively simple to determine. These would be the price you are paying per unit of goods that you intend to resell. Of course, you want to keep these costs as low as possible, which means finding a reliable wholesaler, like Ankorstore, for your procuration needs.

Step #2 – Determine Fixed Costs

Fixed costs for your retail store are going to include things like rent (or your mortgage), utilities, insurance, and any salaries you need to pay.

Step #3 – Determine Revenue/Profit

Your revenue is the money earned from selling goods, before any deductions are made for expenses. Consider it the same as the money being brought into the business.

You can use the straightforward calculation of revenue that is provided below.

Revenue = Number of units sold * Sales price per unit

Your company’s profitability can also be determined by looking at its revenue. A company’s profit can be calculated by subtracting its total costs from its total revenue.

Step #5 – Determine Contribution Margin Ratio

A product’s contribution margin reveals how much of an increase in revenue each unit sold makes to the business. The expansion of your business will benefit from the sale of products that have a large contribution (or sales) margin.

The following formula helps determine the contribution margin ratio accurately.

Contribution margin ratio = Contribution margin per unit ÷ Sales price per unit

If you are familiar with this ratio, you will be able to provide answers to questions such as, “What proportion of the selling price of this unit goes directly towards making a positive contribution to my revenue?”

Step #6 – Create a Spreadsheet

Create a spreadsheet in order to do a break-even analysis, after which the spreadsheet will be converted into a graph. The spreadsheet will calculate the break-even point for each possible combination of sales volume and product price, and it will generate a graph that displays the break-even point for each of these combinations of sales volume and price.

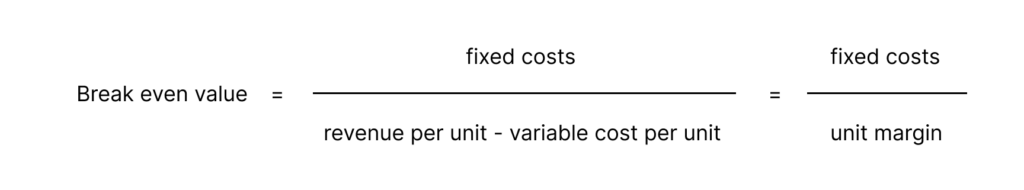

What Is the Break-Even Formula?

Your break-even point is measured in units, and it will tell you exactly how many of those units need to be sold in order for you to make a profit. Beyond this point, you will begin to see a profit in the amount of money you bring in from the sale of further units. If, however, the amount of products you sell is insufficient to reach the break even, your business will experience a financial loss.

In order to perform the calculation, you will need to take your fixed costs and divide them by your contribution margin per unit. Because of this, you may also simplify this formula even further by writing it down as follows:

Since variable costs are always changing, this formula is best written in a spreadsheet. Your break-even point will be displayed on the spreadsheet for a variety of cost and sales prices.

Break-Even Point Example

You may be asking how you can apply this to your current position, whether you are a business owner or are hoping to start your own shop. Let’s look at a real-world scenario to understand what is happening.

Imagine you exclusively sell high-end beauty products. Because you run such an efficient business, you are able to keep your expenses to a minimum. This is only a quick look at your financial situation.

- Fixed costs: £1,200

- Variable costs per unit: £4

- Sales price per unit: £12

Your fixed costs consist of your monthly rent, utilities, a point-of-sales system, and any payments on your business loan. Your variable cost per unit is sourcing the products from a reliable distributor.

Hence;

1,200 ÷ (12-4) = 150

This means you need to sell 150 units monthly to reach the break-even point.

Why Is the Break-even Analysis Important?

Many small and medium-sized enterprises never bother conducting any useful financial analysis. They are unsure about the number of units that must be sold to get a return on their investment.

A break-even point analysis is a strong tool that can be used for planning and decision-making, as well as for drawing attention to important facts such as costs, quantities sold, prices, and a great deal more. It helps with the following:

Cost Calculation

If you want to know whether or not your firm will continue to be profitable if you decide to increase your company’s fixed costs—for example, if you decide to move into a larger and more centrally located (and thus more expensive) retail space or hire another paid employee—a break-even study can help you figure that out.

Budgeting and Setting Targets

By offering an estimate of your profitability in the future month, quarter, or year, a break-even analysis can assist you in developing a budget for the upcoming period.

Motivational Tool

It is possible to set sales benchmarks with the assistance of a break-even analysis, which, in turn, will drive you to work harder when you realise that your firm’s profitability is at risk.

Margin of Safety

The gap that exists between the amount of predicted profit and the point at which operations are profitable again is known as a margin of safety. You may quickly identify instances in which sales are not on track to generate a profit by comparing the break-even point to the predicted profitability of the business.

Setting Goals

After conducting a break-even analysis, you will clearly understand the kinds of objectives that should be achieved to reach a profit margin. This assists you in establishing goals and working toward achieving them.

How to Lower Your Break-Even Point

If the results of your initial break-even point calculation aren’t what you had hoped for, then let’s look at how you may adjust your present plan to reach a break-even point that is appropriate for your company.

Reduce Fixed Costs

If your company has a high amount of fixed expenditures, it may put a lot of strain on its ability to cover its expenses with revenue from sales. If you can cut fixed costs, the amount of income your company needs to generate to be profitable will decrease.

Reduce Variable Costs

Your sales volume directly affects the fluctuation in your variable expenses, which include production and transportation. You could explore negotiating a cheaper price by offering to purchase a minimum quantity every month to reduce the variable costs associated with your business.

Increase Your Selling Price

You may need to raise the price of your good or service if you cannot profit from the current price you are charging. If you raise your prices, you will have to sell less of your product to achieve the same level of profitability.

In addition, before cutting expenses to protect your brand, you should carefully analyze all aspects of those costs, including the associated quality and delivery. When there is an increase in demand or volume, outsourcing products or services can also help lower expenses.

How Can Ankorstart Help Your Business Thrive

You should be able to see that it is necessary to perform regular monitoring and reporting of, for example, average job value and average material prices to determine whether you are on the right track. This has been a quick introduction to the concept of breaking even, as well as the reasons why it is necessary. If you’re an aspiring retailer looking for clear and expert advice on how to get started, we’re here to help.

The business development services offered by Ankorstore will assist you in determining and achieving precisely what it is you want to gain out of your company, whether that be more free time, more money, or less worry.

At Ankorstore, our mission is to help aspiring retailers successfully launch and operate an offline and/or online business. So get in touch with us today!

FAQ

What can a break-even calculation tell me about my business?

A break-even analysis is utilised in a wide variety of contexts within the realm of business, including the trading of stocks and options as well as the budgeting of projects. Owners of small businesses can save themselves time and money by conducting a break-even analysis before investing in new product lines or business ideas that are unlikely to be lucrative.

What are fixed costs?

Regardless of the number of units sold, there will always be the same fixed costs. These are the essential expenses associated with running a company. Depending on the nature of your company, you might need to include or exclude certain kinds of fixed costs in your budget.

What are variable costs?

The amount of product manufactured and sold affects the variable costs. When you produce or sell a greater amount of your product, the variable cost will go up, and the opposite is true when you decrease the quantity.

What should I do if my break-even point is too high?

Don’t be alarmed if the point at which you start making money again is further away than you anticipated. Just contact the experts at Ankorstore!

Related posts "Funding my project"

Starting a new retail adventure is an exciting time for any small business owners, but from ideation to creation is a big step: financing. Read on to learn how to find investors and secure the starting capital you need to fund your retail business.

Creating a cash flow statement can seem daunting at first, but we’ll make it manageable with a clear example of a cash flow statement that will prepare you to better manage your retail store and ensure your finances are in-check.

If you are a small retailer who is trying to find funding, Ankorstart can help. Click on the link to read our informative article on how to get a business loan.

Editing a precise and reliable finance plan for your retail store is not easy. Discover all the tips you need to know in this article.